How to Track, Monitor, and Discern Your Agency’s Risk

Matthew Gordon, with Cap Doctor Associates, Inc., recently joined me on a Wednesday Webcast to talk about cap tracking, self-reporting, and factors that can contribute to putting your agency at cap risk. Read our breakdown of the webinar and tips to protect your agency from the costliness associated with cap overpayments.

Hospice Cap Payment Towards Agencies

In 2023, the cap amount is $32,487, this number usually goes up 2-3% every year. This equates to roughly six months of service provided for beneficiaries at the routine daily rate.

While the cap is a beneficiary cap, it is not assessed at the beneficiary level but rather in aggregate at the agency level. For example, if you have a patient that you’ve had on service for a year, you don’t necessarily have to pay back that money because cap is only calculated in the aggregate, meaning you roll up all the patients you had on service for a year and all their beneficiary credits measure against all the revenue you receive for those patients in an aggregate.

Proportional Vs Streamlined Hospices

Before we begin, it’s important to note that the allocation and monitoring of hospice caps vary between proportional and streamlined hospices. Under the Proportional method the beneficiary credit is allocated based on the dates of service in that specific cap year. On the other hand, the streamlined method gives full beneficiary credit in the year of the initial admission.

Agencies who began operations prior to 2012 had to make an election as to which method they wanted to use and most of these agencies are now on the Proportional method. Agencies who began operations since 2012 were automatically assigned the Proportional method.

Cap Tracking Process

It is essential to evaluate a comprehensive, annual perspective of your hospice’s cap utilization. To do so, consider various factors such as the beneficiary credits accumulated throughout the year, the fluctuation of your patient census, and projected admissions for the remainder of the cap year.

By analyzing these factors, you can assess the potential impact on total credits, revenue, and overall financial cushion for your hospice. Additionally, it is important to consider the long-term effects of patients who leave one hospice to go to another, as this can result in a gradual erosion of credits over multiple years. Continuously monitoring and projecting your cap utilization is the key to ensuring the financial stability of your hospice cap.

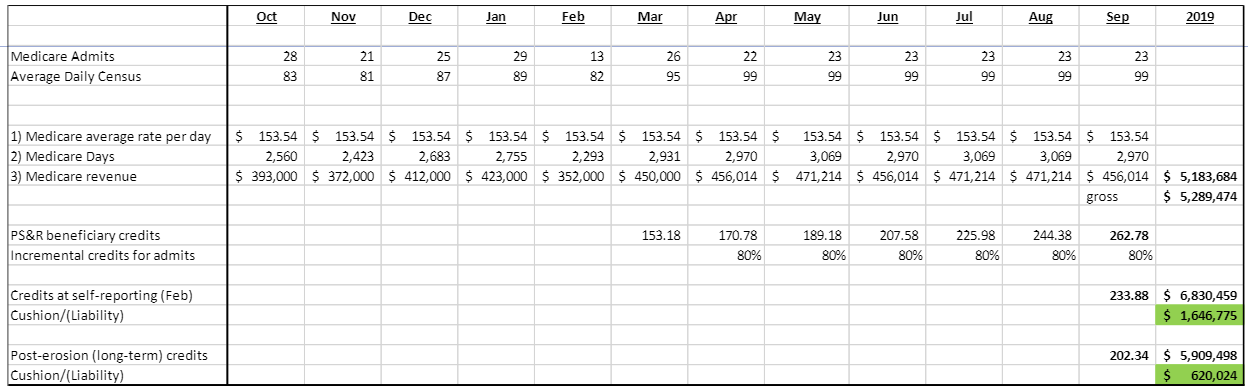

Let’s look at the graph below as an example.

The graph provided serves as an example of this process, displaying the current cap cushion of 1.6 million dollars, as indicated by the 233.88 beneficiary credits. The lower number, 620,024, represents the impact of live discharged patients on cap utilization, known as “long-term erosion”.

Over a three-year period, the 233.88 credits are projected to decrease to 202.34 due to the changing of agencies by these patients. While the agency is projected to remain within the cap limit in three years, this illustration emphasizes the importance of ongoing monitoring and forecasting of cap utilization.

Cap Self-Reporting

Palmetto GBA, the Medicare Administrative Contractor, requires hospice providers to submit a form detailing their hospice numbers. This form, known as the Cap Report, is due by February 28th of each year. If the form is not submitted, the provider will be placed on revenue hold.

Remember, the cap self-reported number is only a snapshot in time and not the final amount. Palmetto allows for a period of three years for the cap result to be re-determined for your hospice. This three-year period begins once you receive the initial determination letter for the most recent year.

Cap numbers may change over time due to patients who were admitted during the initial cap year and are still receiving hospice services, either with your hospice or another hospice. For example, if a patient was admitted on July 1st, 2022, and remained on service for six months, when self-reporting on January 1st, 2023, the cap split would be 0.5 to the 2022 cap year and 0.5 to the 2023 cap year. However, if the patient remains on service for an additional six months, until July 1st, 2023, the cap split would then be 0.75 to the 2023 cap year and 0.25 to the 2022 cap year, resulting in a deterioration of the 2022 cap number by approximately 0.25 credits. As long as patients are still receiving hospice services, your cap numbers will continue to change.

Matthew Gordon recommends having a cushion of at least 10% of total revenue to mitigate the risk of incurring liability during the 3-year look-back period.

Cap Risk Factors

There are various indicators that may indicate that your hospice agency is at risk of exceeding its cap allocation. Matthew Gordon has provided helpful ratios and metrics that can assist in identifying potential cap issues within your agency. These indicators can provide valuable insight into the overall health of your agency’s cap allocation. It is important to stay vigilant in monitoring these indicators and taking appropriate measures to mitigate any potential risks.

Too long average length of stay (LOS)

The cap amount allocated per beneficiary typically covers an average of six months of services. However, if a hospice admits a significant number of long-term patients, your cap allowance will be depleted without being replenished by new, short-term patients.

To assess the potential impact on cap health, Matthew Gordon suggests evaluating the ratio of the census to average monthly admissions. If the ratio exceeds 4:1, it may indicate an excessive number of long-term patients. For example, a census of 40 patients should be accompanied by at least 10 or more monthly admissions to maintain a healthy cap balance. Conversely, if the census is 40 and there are only 6 monthly admissions, it may indicate an excessive number of long-term patients and potential cap issues. If the census is 40 and there are 20 new patients admitted per month, it suggests a high turnover rate with a low average length of stay, indicating that the hospice is likely clear of cap concerns.

Live discharge

Beneficiaries receive their cap allowance in a lump sum. Since cap payments are prorated, they are not redistributed if a patient transfers from one facility to another. As the number of live patient discharges increases, there is a greater likelihood that these patients will receive hospice services from another provider in the future. This can result in a depletion of the cap credit previously allocated to the original hospice provider.

Additionally, whenever a new patient is admitted, it’s critical to know whether the new patient is transferring from a previous hospice, as this can impact the full cap payment.

A live discharge rate of over 25-30% may indicate a potential risk for cap issues.

Low new Medicare admit rate

It is important to consider the cap period of newly admitted patients. If a patient is on their sixth or seventh cap period, the hospice will likely only receive a small fraction of their overall cap credit, as a significant portion of it may have been used at other hospices.

To ensure optimal utilization of cap resources, it is recommended that a majority of new admissions are within their first benefit period. Aiming for at least 75-80% of new admissions to fall within their first benefit period is ideal, as these patients will come in with their full cap credit intact.

Smaller sized hospices are more prone to cap issues

Matthew Gordon classifies smaller hospices as those with 30 patients or fewer. Based on his experience, it is observed that these smaller facilities tend to be more susceptible to risk. This is primarily attributed to the high fluctuation and uncertainty of patient admission numbers, as well as the limited diversity of referral sources.

Admissions declining over time

A plateau in patient admissions may indicate a potential cap risk. This is because when admissions decrease, your longer length of stay patients tend to take up a bigger portion of your census. Simply put, no new patients equals no new cap money coming in.

Cap Mitigation – Short LOS Admits is THE KEY

Increasing your mix of shorter length of stay patients is the only viable solution to address cap challenges. For example, if a patient is admitted and stays on service for 30 days before passing away, the hospice will receive the full cap credit of $32,000. However, the revenue generated during those 30 days is typically only 5,000-6,000 dollars, resulting in a surplus of $26,000 that can be used to offset the costs of caring for patients with longer lengths of stay.

However, this can be a challenging task, particularly for smaller and mid-size hospices, as they may face difficulty in acquiring such patients. Below are a few tips from Matthew Gordon to achieve a healthy ratio of patients.

Referral source analysis (internal or external)

The first tip is to conduct a referral source analysis, both internally and externally. An internal analysis will provide data on the origin and characteristics of the patients being admitted to your hospice. By analyzing this data, you can identify patterns and trends in the types of patients being referred by different sources.

Additionally, there are cost-effective external sources, such as subscriptions to physician data, which can provide insights into referral patterns and the average length of stay for patients referred by specific physicians. This information can assist in identifying potential sources for shorter length of stay patients.

Hospital Arrangements and Inpatient Facilities

Building strong relationships with hospitals and inpatient facilities can lead to a steady flow of referral patients. These patients often require hospice care and can be referred to your agency by hospitals with whom you’ve built rapport with.

Streamlined Hospices

For streamlined hospice agencies, the focus should be on increasing admissions, as the full cap credit is granted in the first year of admission. Achieving a short length of stay is not necessarily required, as the cap credit rollover into the next period is not an issue for streamlined hospices. However, it is crucial to ensure that patients are admitted by September 30th to take advantage of the full cap credit.

Receiving Cap Letters

If your hospice owes money during the self-reporting period, you may face additional financial liabilities during the three-year look-back period. Even if no money is owed during the self-reporting period, the hospice may still incur financial obligations. If patients from a prior cap year are still receiving hospice services, erosion will continue. The final cap liability can only be determined once all patients from a given cap year have passed away.

It is common to receive multiple letters for a single cap year due to the ongoing erosion of beneficiary credits over several years. The exact month in which these letters will be received is not specified. However, once a Cap letter is received, the hospice has a 15-day window to pay the amount due or request a payment plan.

Payment Plans

If you get a letter saying you owe money due to a cap overpayment, you can select various payment plans. If you elect for a 6-to-11-month payment plan, all that’s required is an amortization schedule. However, if you elect a payment plan that spans greater than a year, your hospice agency must provide income statements, balance sheets, and cash flow statements for prior years plus projective statements moving forward for the next fiscal year. The interest rate on these payment plans is roughly 10%, so only use the extended repayment plan if you must.

In summary, tracking, monitoring and managing your hospice cap is essential to the success of your hospice organization. If these limitations are not properly monitored and managed, they can seriously devastate an agency. By staying on top of the program, you can ensure that you are providing high-quality care to your patients while also keeping your organization financially stable.

Knight HC Financial and The Cap Doctor work closely together, if you’re interested in getting help to manage your hospice cap, we recommend reaching out to Matthew Gordon, CPA at matthew@Capdoctorassociates.com or 404-707-0992.